In the final instructions for the Schedules K-2 and K-3 for the 2022 tax year that were published recently, the IRS added an important exception to the requirements for filing Schedules K-2 and K-3 with respect to domestic filing (domestic filing exception) for both partnerships and S corporations. Importantly, a flow-through entity with no foreign source income, no assets generating foreign source income, no foreign partners, or no foreign taxes paid or accrued might still need to report information on Schedules K-2 and K-3. tax or certain withholding or reporting obligations of its partners or shareholders must file the Schedules K-2 and K-3.

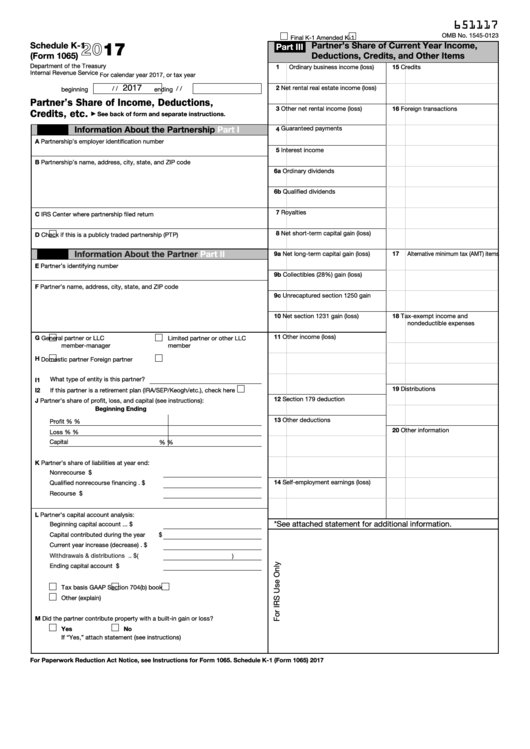

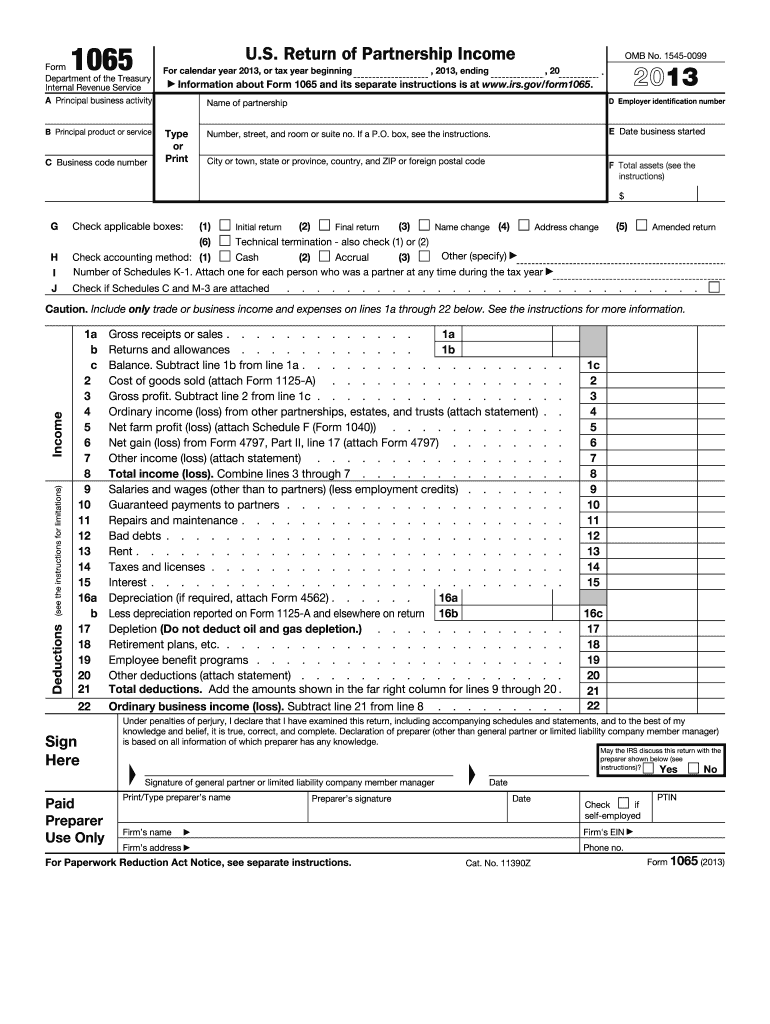

Any flow-through entity that is required to file Form 1065, 1120-S, or 8865 and that has items that are relevant to the determination of U.S. Persons With Respect to Certain Foreign Partnerships), (together, flow-through entities). These schedules accompany Forms 1065 (partnerships), 1120-S (S corporations), and 8865 (Return of U.S. Such international items previously were included as footnotes to Schedules K and K-1. Schedule K-2 (Partners’ Distributive Share Items−International) and Schedule K-3 (Partner’s Share of Income, Deductions, Credits, etc.−International) replaced and expanded reporting requirements for international tax items in an effort by the IRS to expand and streamline the presentation and level of detail provided with respect to U.S. The Internal Revenue Service (IRS) introduced Schedules K-2 and K-3 beginning with tax year 2021.

0 kommentar(er)

0 kommentar(er)